Bitcoin’s recent price volatility has led many to wonder whether large Bitcoin holders are taking advantage of price drops to accumulate more Bitcoin. While some metrics may initially suggest an increase in long-term holdings, a closer look reveals a more nuanced story, especially after the current extended period of unstable consolidation.

Are long-term holders accumulating?

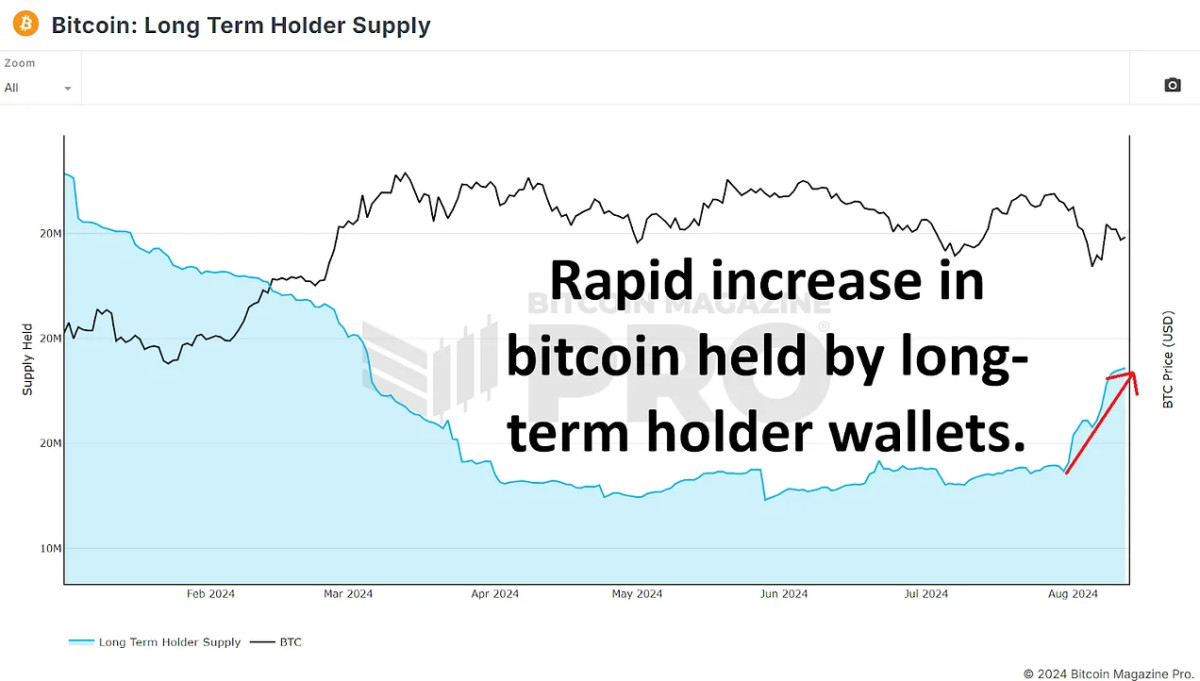

At first glance, it appears that long-term Bitcoin holders are increasing their holdings. According to Supply of long-term holdersSince July 30, the amount of BTC held by long-term holders has increased from 14.86 million to 15.36 million BTC. This increase of around 500,000 BTC has led some to believe that long-term holders are aggressively buying the dip, which could set the stage for the next significant price rally.

However, this interpretation can be misleading. Long-term holders are defined as wallets that have held BTC for 155 days or more. This week we just surpassed 155 days since our most recent all-time high. Therefore, it is likely that many short-term holders from that period have simply moved into the long-term category without any new accumulation having occurred. These investors are now holding onto their BTC, waiting for higher prices. Therefore, in isolation, this chart does not necessarily indicate new buying activity by established market participants.

Coin Days Destroyed: A Contradictory Indicator

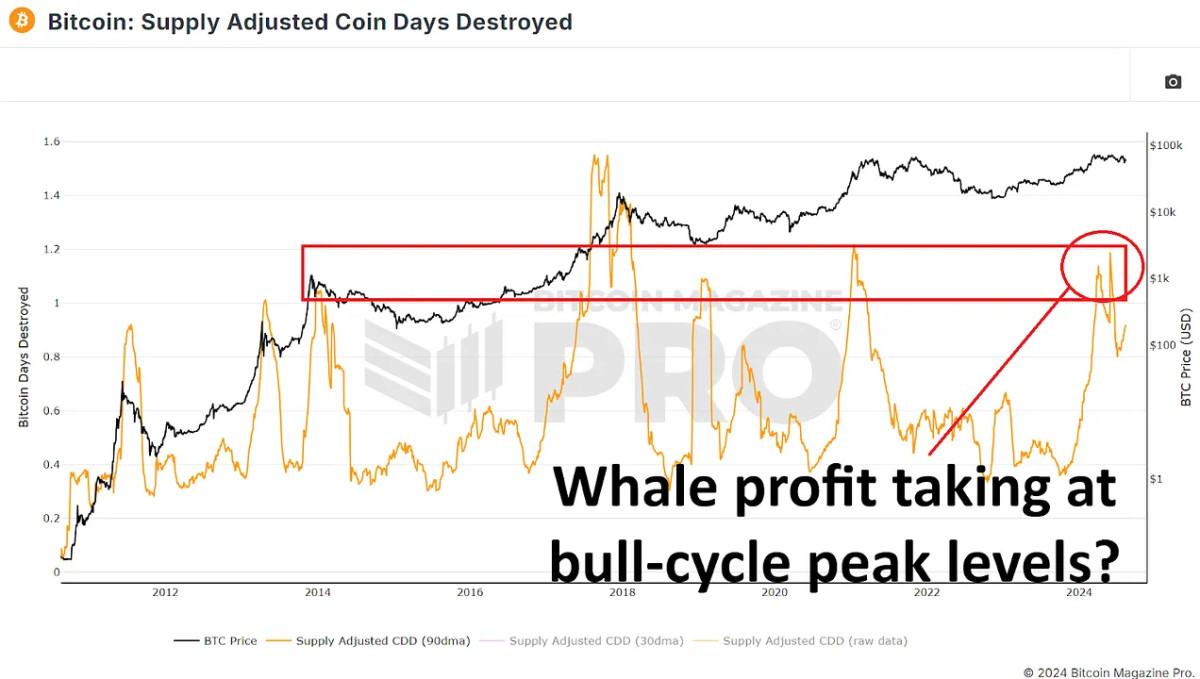

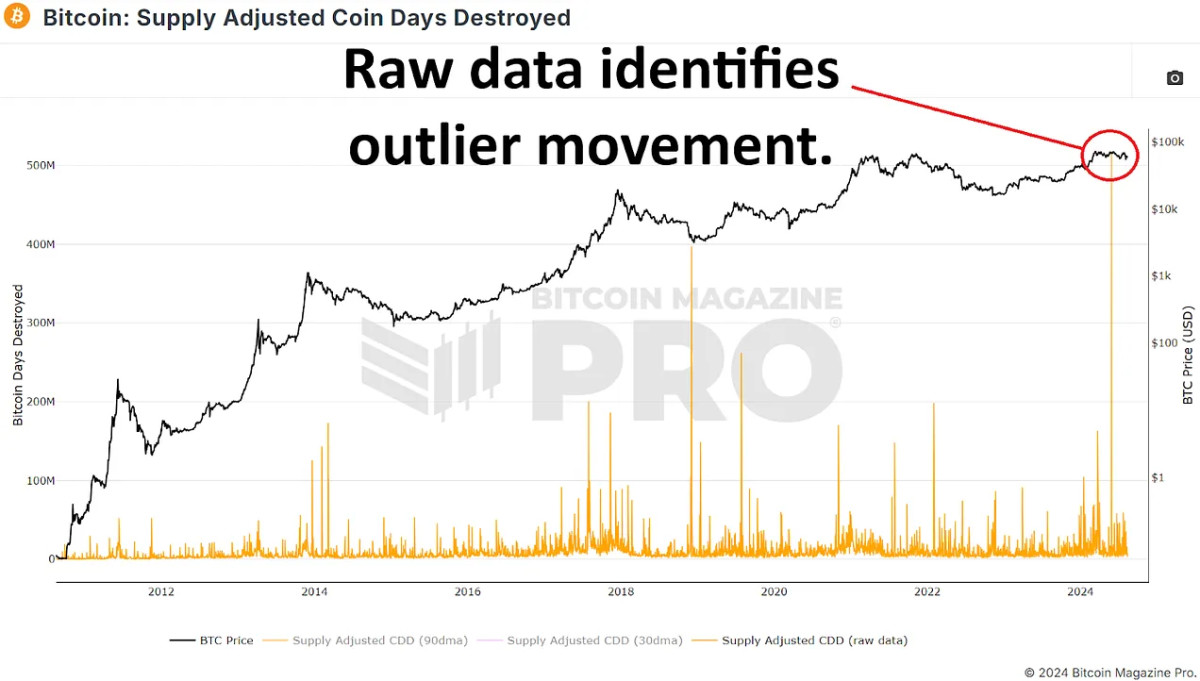

To further explore the behavior of long-term holders, we can examine the Days of destroyed coins with tight supply Metric over the recent 155-day period. This metric measures the speed of coin movement, giving more weight to coins that have been held for extended periods. An increase in this metric could indicate that long-term holders who own a substantial amount of bitcoin are moving their coins, likely indicating more selling rather than accumulation.

We have recently seen a significant spike in this data, suggesting that long-term holders might be distributing BTC rather than accumulating. However, this spike is mostly skewed by a single massive transaction of around 140,000 BTC from a known Mt. Gox wallet on May 28, 2024. When we exclude this outlier, the data looks much more typical for this stage of the market cycle, comparable to the periods of late 2016 and early 2017 or mid-2019 to early 2020.

The behavior of whale portfolios

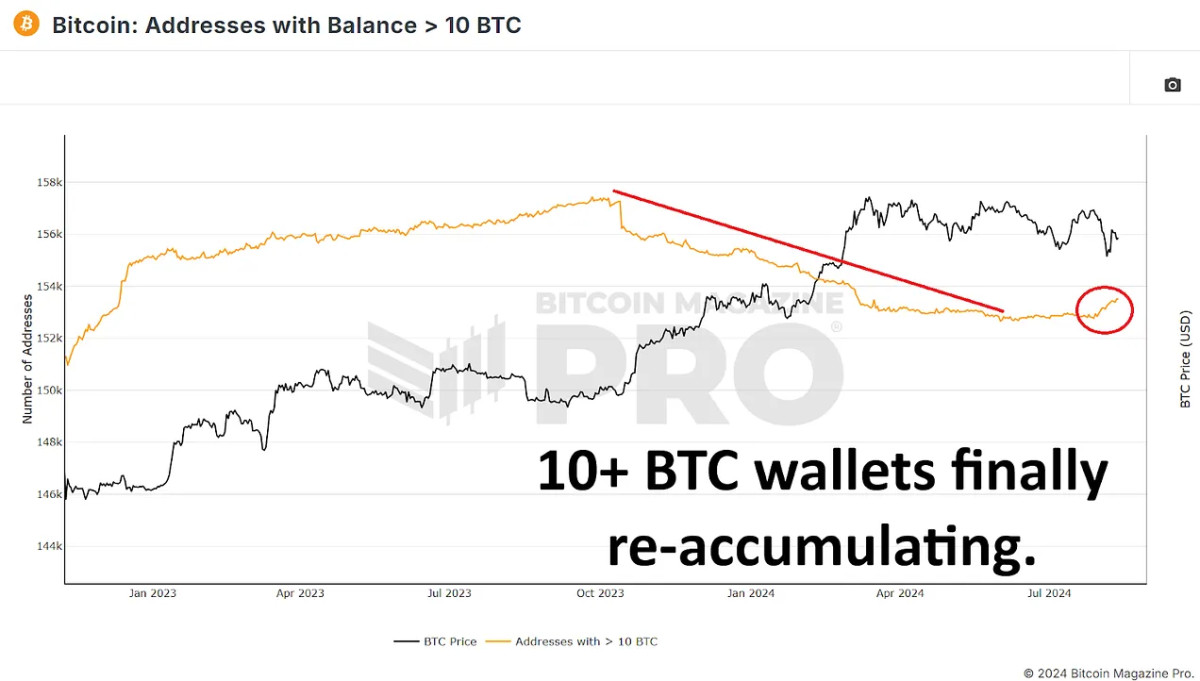

To determine whether whales are buying or selling bitcoins, it is critical to analyze wallets that contain substantial amounts of coins. By examining wallets with at least 10 BTC (minimum of ~$600,000 at current prices), we can evaluate the actions of important market participants.

Since Bitcoin's peak earlier this year, the amount of Wallets containing at least 10 BTC has increased slightly. Similarly, the number of Wallets containing 100 BTC or more It has also seen a modest increase. Considering the minimum threshold that must be included in these charts, the amount of bitcoins accumulated by wallets holding between 10 and 999 BTC could represent tens of thousands of coins purchased since our most recent all-time high.

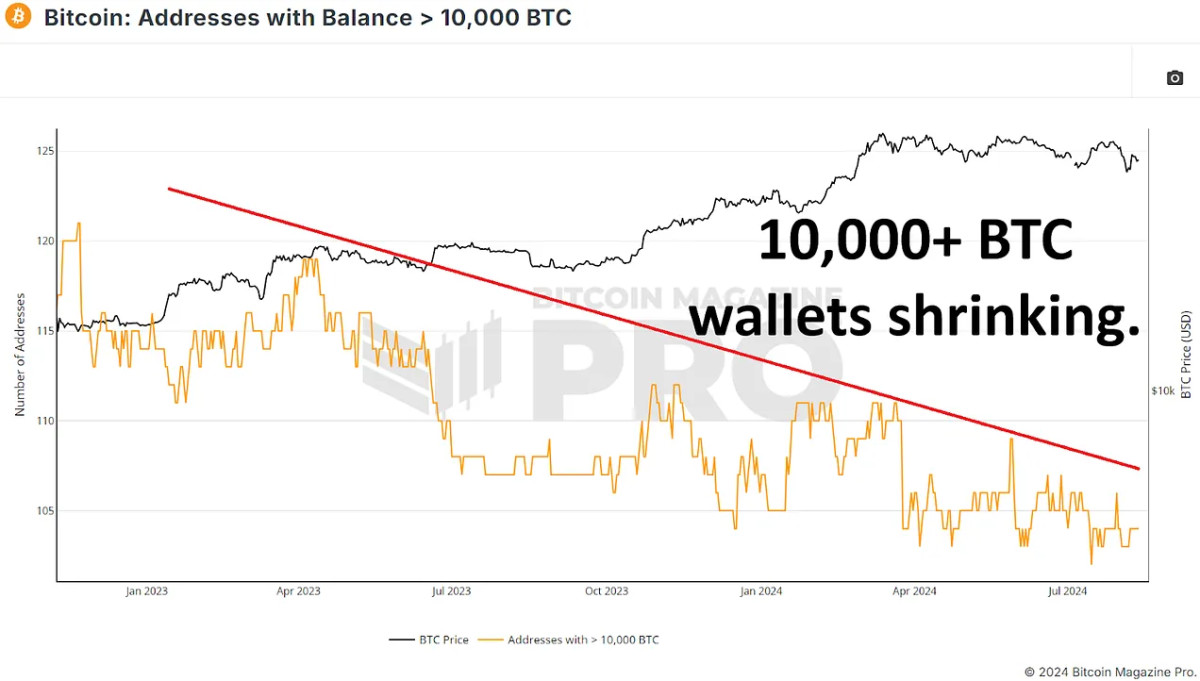

However, the trend reverses when we look at the larger data. Wallets containing 1000 BTC or moreThe number of these large wallets has decreased slightly, indicating that some of the top holders might be distributing their BTC. The most notable change is in Wallets containing 10,000 BTC or morewhich have decreased from 109 to 104 over the past few months. This suggests that some of the largest bitcoin holders are likely taking profits or redistributing their holdings into smaller wallets. However, considering that most of these extremely large wallets will typically be exchanges or other centralized wallets, it is more likely that these are a collection of coins from traders and investors rather than a single individual or group.

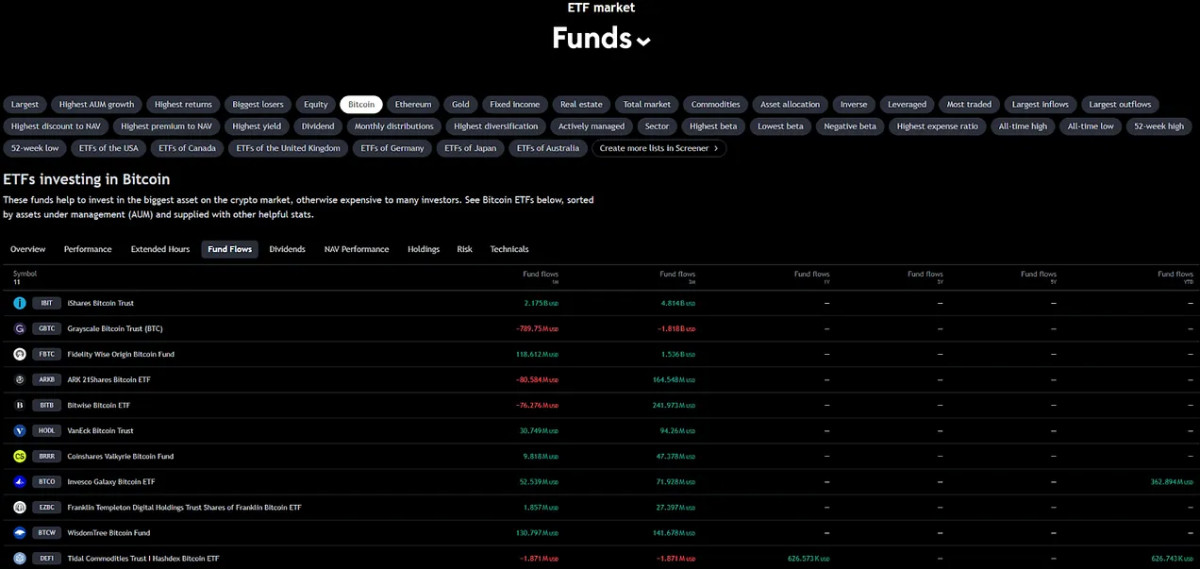

The role of ETFs and institutional capital inflows

Since reaching a peak of $60.8 billion in assets under management (AUM) on March 14, BTC ETFs have seen an AUM decline of around $6 billion; however, if we take into account the decline in the price of Bitcoin from our all-time high, this roughly equates to an increase of approximately 85,000 BTC. While this is positive, the increase has only negated the amount of newly mined Bitcoin over the same period, also 85,000 BTC. ETFs have helped reduce selling pressure from miners and potentially large holders, but they have not accumulated enough to positively impact price.

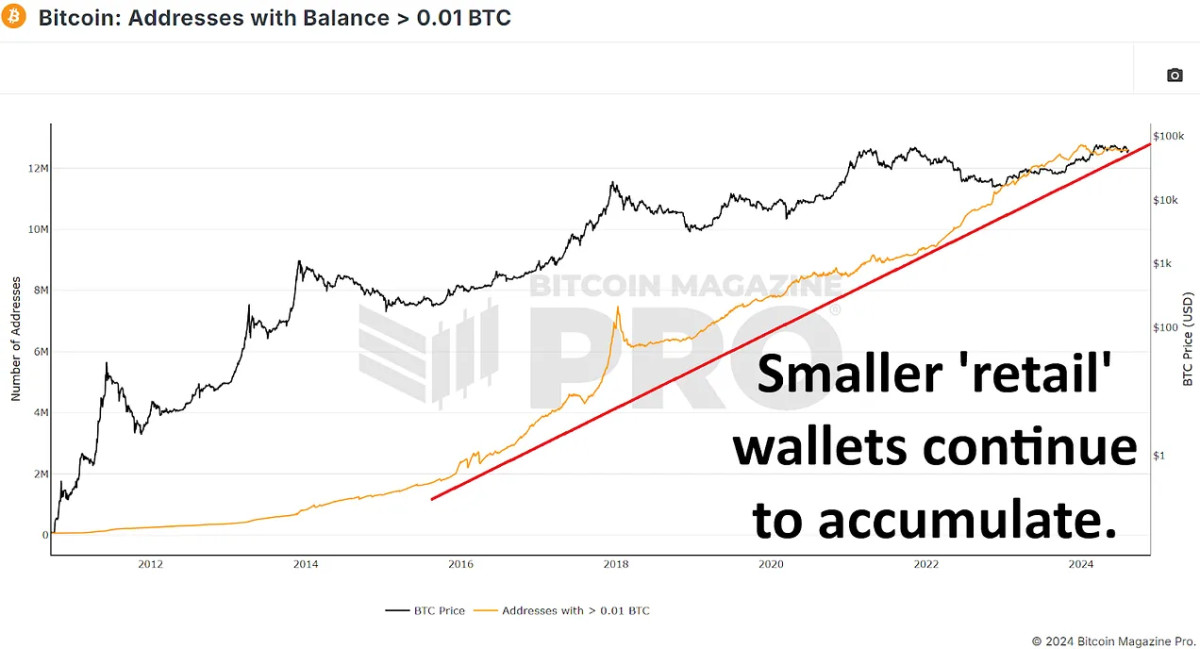

Interest in retail is on the rise

Interestingly, while large holders appear to be selling BTC, there has been a significant increase in smaller wallets, those maintaining between 0.01 and 10 BTC. These smaller wallets have added tens of thousands of BTC, demonstrating increased interest from retail investors. There has been a net shift of around 60,000 bitcoins from wallets larger than 10 BTC to smaller 10 BTC wallets. This may seem alarming, but considering we typically see millions of bitcoins move from large, long-term holders to new market entrants over the course of an entire bull cycle, this is not a cause for concern at the moment.

Conclusion

The narrative that whales have been accumulating bitcoin on dips and during this period of consolidation does not appear to be true. While long-term holder supply metrics initially appear bullish, they largely reflect the transition of short-term holders into the long-term category rather than fresh accumulation.

Rising retail holdings and the stabilizing influence of ETFs could provide a solid foundation for future price appreciation, especially if we see renewed institutional interest and continued retail inflows post-halving, but they currently contribute little to any Bitcoin price appreciation.

The real question is whether the current distribution phase takes hold and sets the stage for a new round of accumulation, which could propel Bitcoin to new highs in the coming months, or whether this flow of old coins to newer participants continues and likely suppresses upside potential for the remainder of our bull cycle.

🎥 For a deeper dive into this topic, check out our recent YouTube video here: Are Bitcoin whales still buying?

And don't forget to check out our other recent video on YouTube here, where we discuss how we can potentially improve one of Bitcoin's best metrics:

Leave feedback about this