What is modularity anyway?

Modularity is the result of a curious experiment being carried out on Ethereum in reaction to the poor scaling properties of blockchains. To address this bottleneck, developers have taken the radical approach of auctioning core functions of the main chain to… other blockchains.

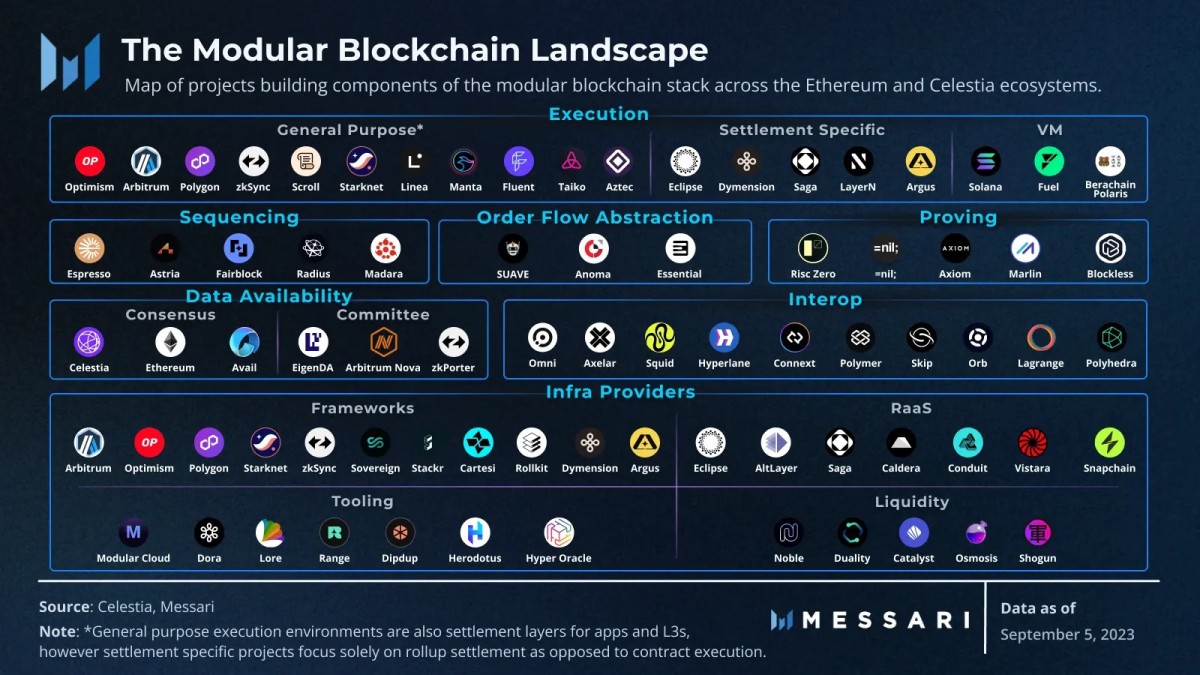

Focused on stacked technology, this modular transformation has completely redefined how products and services are built on top of Ethereum. Separating each element of the stack allows different architectures to be designed according to their use cases. Understandably, this has led to a proliferation of…blockchains.

It is not a joke. Everyone is getting hilariously rich selling blockchains, again.

While each new consensus protocol offers novel and interesting scaling opportunities, it also introduces a strange coordination problem. If users are dispersed across different networks, how does the economy become more efficient? How can we sync everyone in this distribution? Maybe one more… blockchain?

They are turtles all the way down.

This fragmentation of the ecosystem has had some obvious consequences. On the one hand, users are isolated and trapped between intermediaries. While rollups have compelling trust minimization properties, the inefficiencies created by transferring in and out of those systems generate unreasonable costs for users. It also exposes them to riskier options like bridges and centralized services.

For developers, the lack of interoperability between platforms creates friction and fosters a competitive rather than collaborative environment. Every two days a new protocol is created for new and existing computers to compete with another copy of the same applications. In many cases, teams choose to “bet on themselves,” stepping into their own ecosystem (read: blockchain). It is essential to highlight the attractiveness of this model, which allows the customization and optimization of various components for each application. This flexible architecture allows anyone to contribute their unique frameworks and inspire new designs. The possibilities are endless!

Unfortunately, those incentives have resulted in the fragmentation of the network effect. If nothing created fits, users will be consolidated into just a handful of competing networks. As a result, economic activity is concentrated in fewer authorized systems.

This type of modularity has taken people away from the goal when it shouldn't be that way. Using different interfaces to interact with the consensus protocol is a perfectly valid idea. However, Ethereum's strategy is problematic; considers interoperability more as an optional feature than as a fundamental design principle. As long as Ethereum continues to seek scalability by multiplying blockchains, the debate will persist, providing ample opportunities for competitors to exploit these divisions and foster discord. Divide and conquer.

The Bitcoin opportunity

In Bitcoin, a different architecture is emerging that favors a fundamentally different design. Using Lightning as an interoperability backbone, developers are slowly moving towards a technology stack much closer to Bitcoin's peer-to-peer model.

Instead of trying to replicate global shared states, protocols like Cashu or Fedimint are being optimized for local and permissionless interactions. Financial services can now be deployed across different economic centers and remain connected via the Lightning Network.

Liquidity providers, atomic bridges and cash mints. A novel financial network that shares the same settlement layer.

Nostr's arrival provides the social abstraction that ties everything together. A social network based on principles similar to those of Bitcoin, it provides a simple set of rules designed to maximize interoperability. By avoiding being prescriptive about the features it enables, Nostr is unleashing a cambrian explosion of open innovation.

Today, different projects are starting to explore ways to facilitate Bitcoin trading by making Nostr a native component of the Bitcoin user experience. The public key infrastructure underlying the protocol is a natural fit for wallets and other payment applications, allowing them to communicate with each other and exchange messages securely. This communication layer can connect users to others and to various services available over the network. Standards like Nostr Wallet Connection they are creating new opportunities for Bitcoin applications to interact with the growing Nostr ecosystem.

A case study

Projects like Riot They perfectly embody the differences in this modular vision of Bitcoin. Users can simultaneously connect with services such as Nostr Relays, Fedimint federations and Lightning Service Providers (LSP). Each of these grants access to an increasing number of features and applications. By using Nostr as a discovery service, we can leverage our social network to natively identify and access apps and services supported by our peers. This trust network presents an interesting alternative to so-called trustless systems. Participants can begin to rely on market incentives to engage in more efficient exchanges that are not hampered by the trade-offs required by more decentralized systems.

Over time, markets will emerge for liquidity providers, cash mints, lenders and coinjoin coordinators to advertise your services through Nostr. Civkit's decentralized order book projects could integrate seamlessly with Mutiny and allow users to participate in peer-to-peer exchanges. Each integration is designed around permissionless engagement so users can maintain full sovereignty over their interactions.

Platforms versus protocols

Bitcoin's modular history is not without risks. Critical pieces of the puzzle, such as LSPs, involve significant capital requirements that will create economies of scale among competing providers. The growth of electronic mints may be hampered by regulatory concerns and operator fraud. The Nostr relays have already demonstrated this. centralization trends and it is not yet clear how the network topology will develop.

The success of this approach depends on market optionality and it is essential that the barriers to entry for these businesses remain low. A number of different efforts are being deployed to that end. For example, several Lightning companies are currently collaborating on a specification that would allow any market player to implement their own LSP.

It's probably too early to predict how any of those architectures and protocols will evolve. As both worlds continue to collide, rollups are likely to find their place within the Bitcoin ecosystem. Specific application designs, such as exchange rollups or zkCoins it does not require a global state and could perhaps be made to be interoperable with Lightning.

The tension between both methods is somewhat reminiscent of the early days of the Internet. Commercial interest may favor platforms that allow them to capture parts of the network effect to monetize it. It could take longer for more open, permissionless protocols to really take off. The Internet provides a cautionary tale regarding the consolidation of services and applications into walled gardens. Hopefully, Bitcoin's current development path becomes a future that prioritizes interoperability and permissionless access over financial silos.

Leave feedback about this