Photo by Darren Halstead on Unsplash.

Key takeaways

- Sixteen Nobel economists express concern about Trump's possible re-election and its economic risks.

- Economists cite rising inflation and instability as major threats under Trump's economic policies.

Share this article

Sixteen Nobel Prize-winning economists have warned that Donald Trump's possible re-election could damage the US economy and reignite inflation, a development with major implications for the broader crypto market.

The economists letterAn article published Tuesday argues that Trump’s policies would lead to economic instability and higher consumer prices. They claim that his “fiscally irresponsible budgets” could reignite high inflation, and contrast this with praise for President Biden’s economic record, including investments in infrastructure and clean energy.

This warning comes as Trump, now a convicted criminalhas turned towards a pro-cryptocurrency stance In his campaign, he has promised to end what he calls the “American The government's hostility towards cryptocurrencies. and has begun accepting crypto donations. This move represents a marked shift from his previous critical views on cryptocurrencies and digital assets in general.

“We believe a second Trump term would have a negative impact on the US economic position in the world and a destabilizing effect on the US domestic economy,” the economists said.

Crypto industry leaders like Cathie Wood support Trump's presidential bid, believing that a Trump victory is “the best for our economy.” Founders like the Winklevoss brothers also support Trump, despite his donation to the campaign. being reimbursed.

Data on cryptocurrencies and inflation

The possibility of renewed inflation under the Trump presidency could have mixed effects on the cryptocurrency market. While some see Bitcoin as a hedge against inflation, data shows a negative correlation between its price and rising consumer prices. However, cryptocurrencies often experience gains when the money supply (M2) grows, which could occur under expansionary fiscal policies.

Recent cryptocurrency market rallies have already raised concerns about potential inflationary impacts. The “wealth effect” from unrealized crypto profits could boost consumer spending, potentially injecting demand-driven inflation into the economy. This could force the Federal Reserve to reconsider planned interest rate cuts.

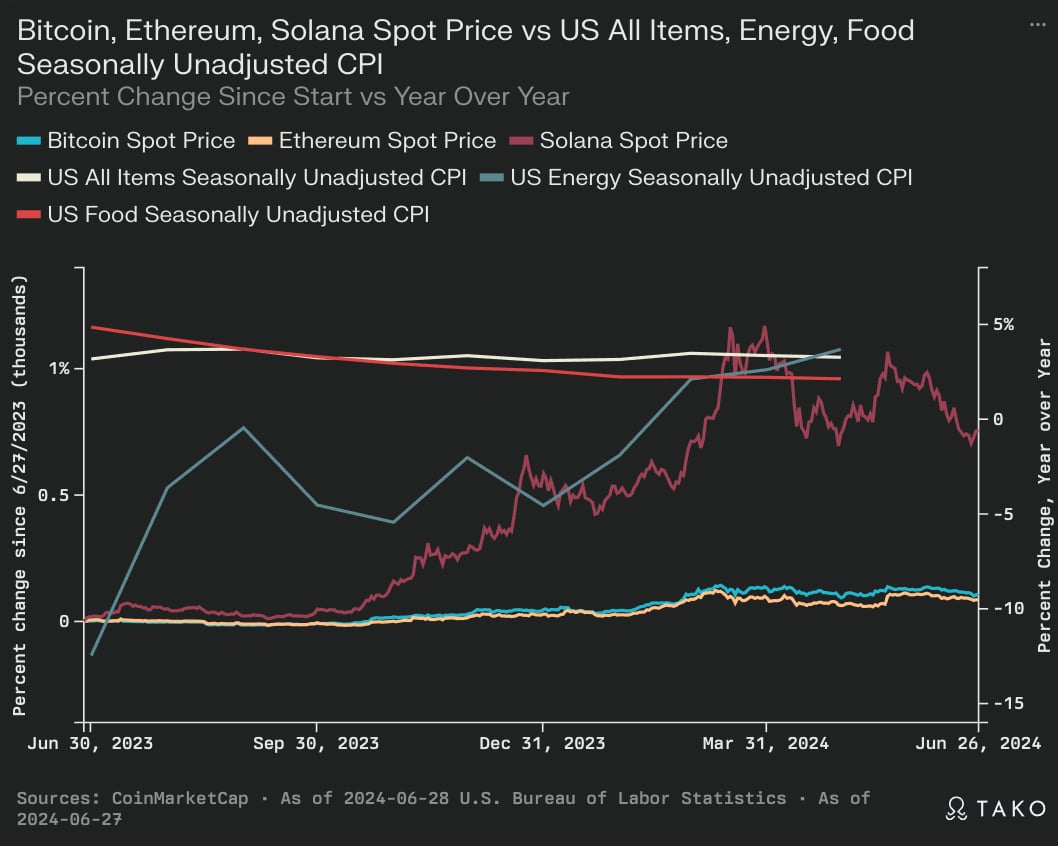

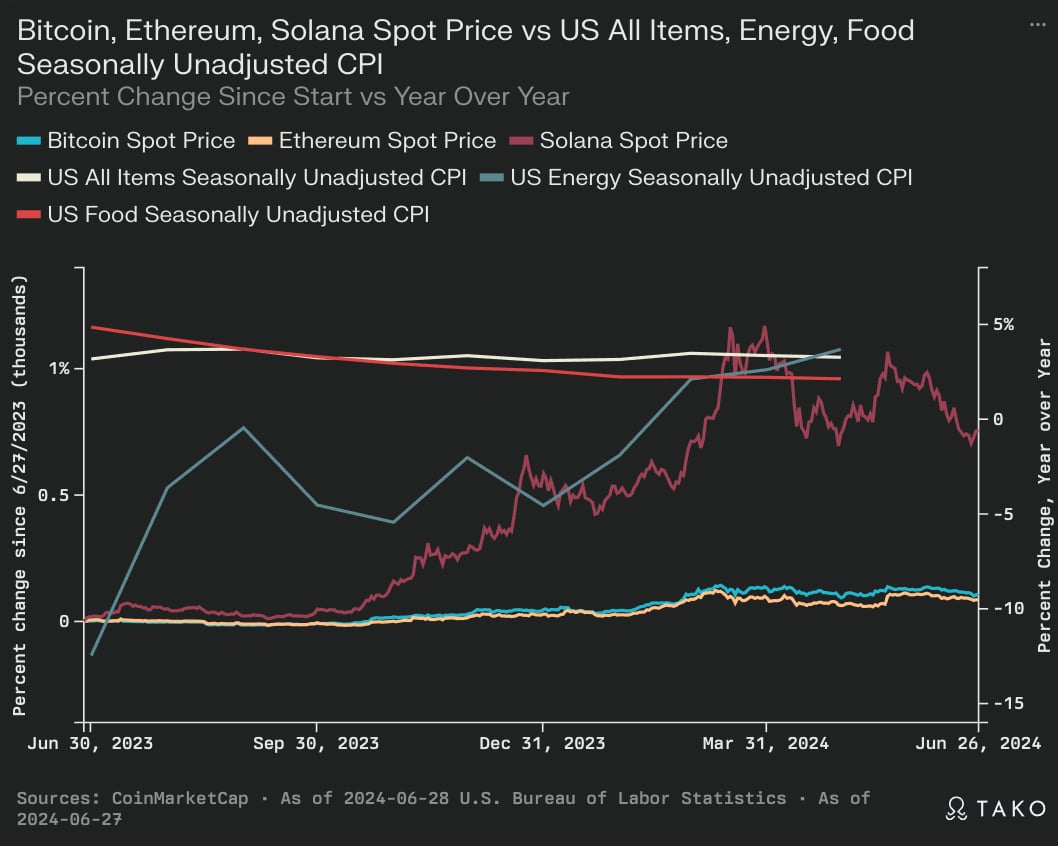

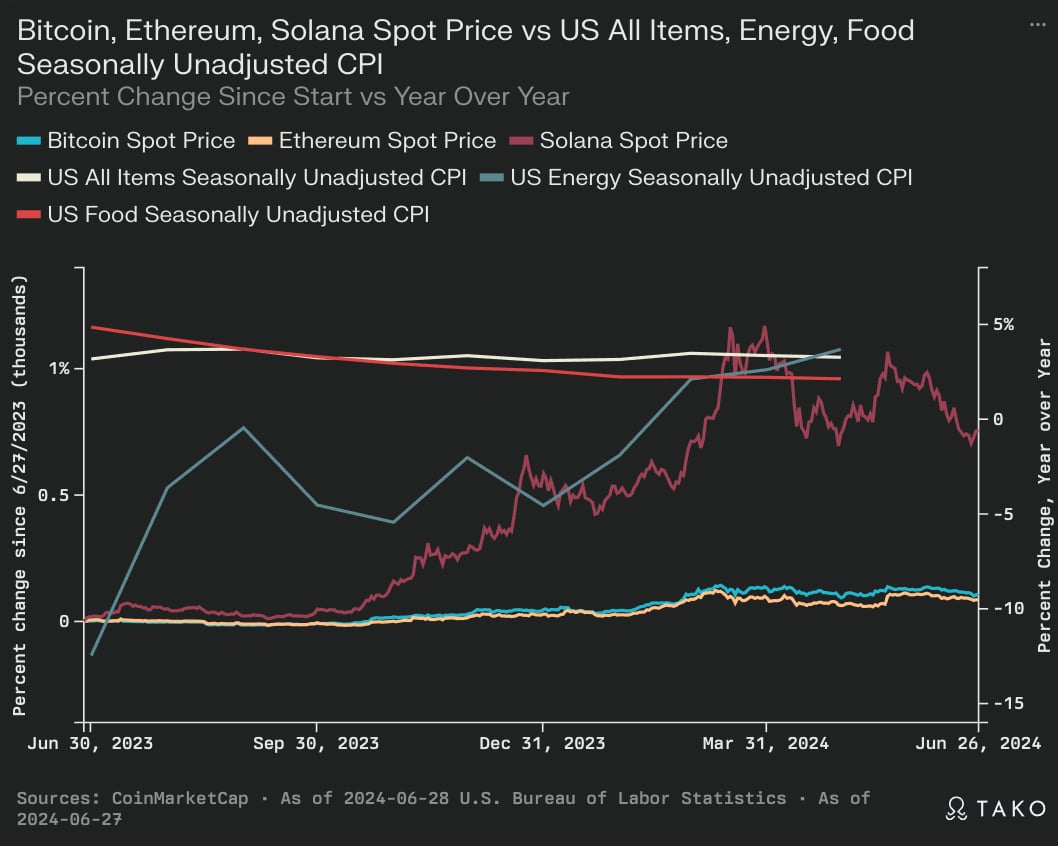

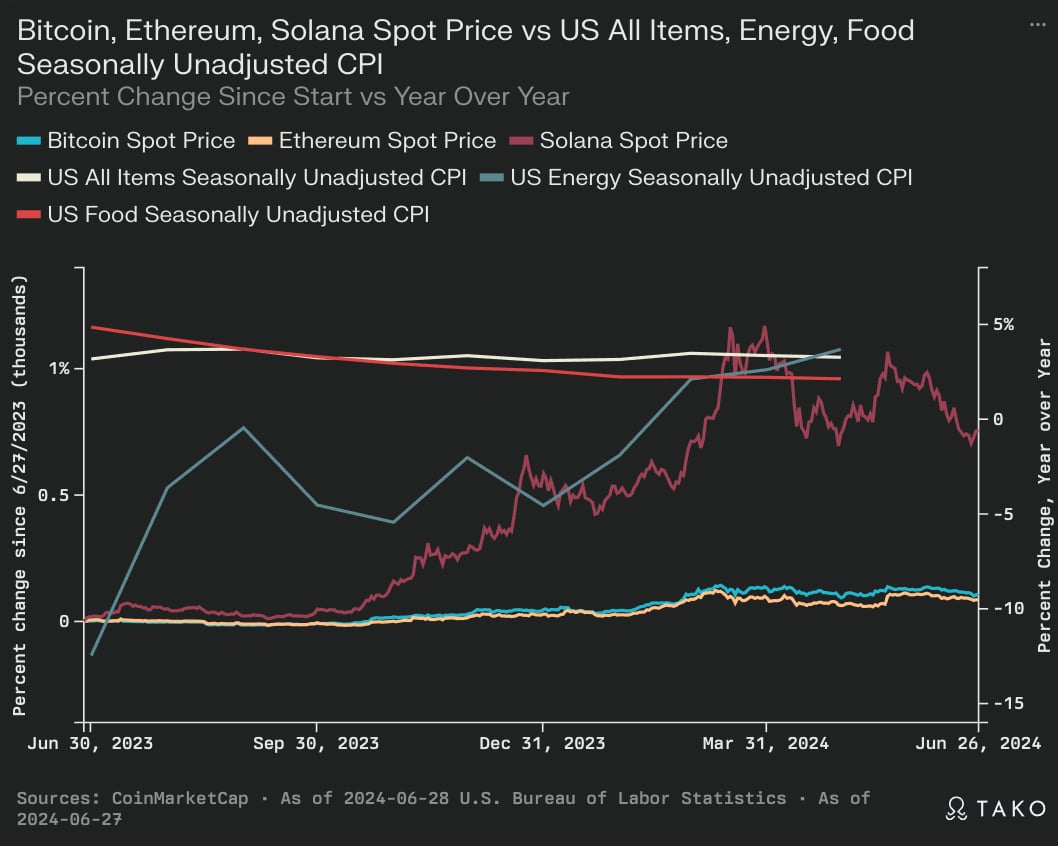

The chart below, sourced from Perplexity and based on data from CoinMarketCap, shows that there is a complex relationship between economic factors and cryptocurrency performance.

The chart shows that cryptocurrency prices, particularly Bitcoin, Ethereum, and Solana, have shown increased volatility compared to traditional CPI measures over the past year. This volatility could be exacerbated by the economic instability warned by Nobel economists in the event of Trump's re-election.

The chart indicates that while cryptocurrencies have seen significant price appreciation, they are still susceptible to sharp corrections. These corrections often coincide with periods of economic uncertainty, which could become more frequent under policies described as “fiscally irresponsible” by Nobel economists. The unpredictable nature of Trump's policymaking style, as highlighted in the warning, could lead to increased market volatility, which could deter institutional investors and slow the widespread adoption of cryptocurrencies.

The data also shows that energy prices have a notable impact on the overall CPI. Trump's energy policies, which may differ significantly from current approaches, could cause fluctuations in energy costs. This, in turn, could impact mining profitability and network security for proof-of-work networks like Bitcoin, which could destabilize the broader crypto ecosystem.

Economists’ concerns about international relations under a Trump presidency could also negatively impact the global nature of crypto markets. Tense diplomatic relations could hamper cross-border transactions and collaborative efforts to develop global crypto regulations, potentially fragmenting the market and reducing liquidity.

For the cryptocurrency industry, the economists' warning highlights the complex interplay between macroeconomic policies, inflation and digital asset markets. While Trump's pro-crypto stance may seem favorable, the broader economic instability predicted by these economists could create a challenging environment for cryptocurrencies.

The contrasting economic visions presented by Trump and Biden, and their potential impacts on inflation and monetary policy, are likely to be key factors influencing the trajectory of the crypto market in the run-up to and following the 2024 US presidential election.

Share this article

Leave feedback about this