The price of Bitcoin has been under significant bearish pressure in recent weeks, and this crypto researcher has explained the role of demand in the market correction.

Apparent Demand for BTC Is Falling: Cause for Alarm?

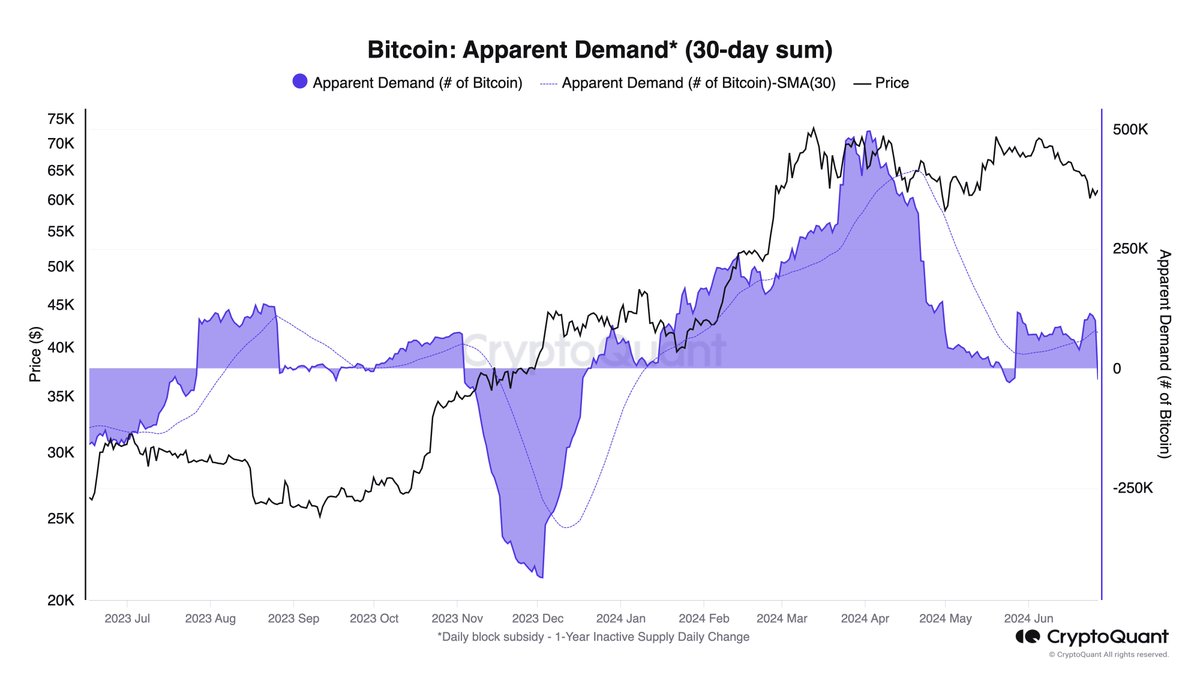

In a recent post on the X platform, CryptoQuant's head of research, Julio Moreno explained how the latest Bitcoin price correction is related to falling Bitcoin demand. This analysis is based on the apparent demand metric for Bitcoin on the CryptoQuant platform.

The calculation of apparent demand is often used in financial markets to evaluate demand by comparing production levels and changes in inventories. Basically, this metric provides a clear picture of whether demand is increasing or decreasing.

In the case of cryptocurrencies, such as Bitcoin, apparent demand is calculated using the concept of idle supply. This concept tracks the amount of Bitcoin that has not been moved or transferred over a given period.

As Moreno highlighted, the chart below uses 1-year idle supply as a “proxy for inventory.” This implies that it monitors the amount of BTC that has not been moved or transacted for over a year.

Chart showing BTC apparent demand and price | Source: jjcmoreno/X

According to data from CryptoQuant, approximately 23,000 BTC have left the 1-year dormant supply in the last 30 days. This suggests a decline in demand for Bitcoin, as it seems long term investors are choosing to download and move their Bitcoin.

This decline in demand has several implications, particularly on the value of the leading cryptocurrency. For example, CryptoQuant's head of research pointed out that low demand is one of the catalysts for the recent price correction.

The influx of significant amounts of BTC from long-term holders into the market increases available supply, putting downward pressure on prices. Additionally, price declines can occur when market buying pressure is insufficient to absorb the additional supply.

CryptoQuant revealed in a weekly report that demand for Bitcoin has decreased significantly compared to the first quarter, following the launch of the digital currency in the US. spot exchange traded fundsAs prices are currently on a downward trend, it seems that an increase in demand for BTC may boost the resumption of the current uptrend.

Bitcoin price at a glance

At the time of writing, the price of Bitcoin is around $60,790, reflecting a 1.6% drop over the past week. According to data from CoinGecko, the market leader has fallen almost 6% in the last week.

The price of BTC thickens around the $60,000 mark on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Leave feedback about this