Intel Corporation has successfully sold its entire stake in Arm Holdings as part of a comprehensive restructuring initiative, aiming to improve its financial position amid a turbulent market environment and ongoing competition.

Brief summary:

- Intel sold 1.18 million shares of Arm Holdings, raising about $147 million.

- The move is part of a broader strategy by CEO Pat Gelsinger to realign the company's financial structure to meet intense competition.

- The move comes after a worrying financial report that saw Intel's share price fall nearly 60% this year, prompting major job cuts and a restructuring plan.

In a significant move that signals its continuing financial troubles, Intel Corporation has sold its entire stake in the British chip company Arm holdingsa decision disclosed through a regulatory filing. The sale of 1.18 million shares is expected to strengthen Intel's balance sheet, generating approximately 147 million dollars based on Arm's average share price from April to June.

As the semiconductor industry faces fierce competition, particularly from companies focused on artificial intelligence, Intel CEO Pat Gelsinger The company described the divestment as part of “Intel’s most substantial restructuring since the transition from memory chips four decades ago.” The adjustment follows the company’s report of diminished quarterly results and a subdued outlook for the period ahead, leading to the biggest one-day drop in Intel’s stock price in half a century — a staggering $1.2 billion drop. 26% decline.

The company's balance sheet was already under pressure, with cash reserves of 11.3 billion dollars but liabilities amount to approximately 32 billion dollars at the end of June. This has led Intel to initiate an ambitious plan 10 billion dollars cost reduction strategy that includes cutting approximately 15,000 jobssuspending its fourth-quarter dividend and cutting capital spending.

Intel's challenges have been compounded by the market's rapid shift toward AI-focused chips, a trend that has seen rivals such as AMD and Qualcomm race forward, inspired by the success of NvidiaDuring this financial crisis, Gelsinger acknowledged that Intel's latest losses were due to an attempt to accelerate the production of its new Core Ultra PC Chipsthat are specifically designed to handle AI workloads.

“Intel must align its cost structure with the latest operating model and fundamentally change the way the company operates,” Gelsinger said after a string of disappointing results.

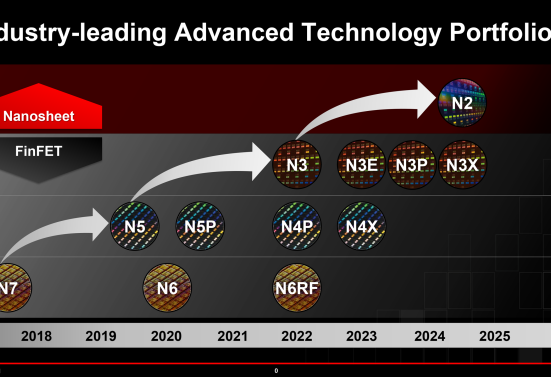

The restructuring also puts a spotlight on Intel's foundry business as it strives to regain market dominance lost to manufacturers such as Telecommunications management company in Taiwan and Samsung in South Korea. Despite this aggressive strategy, Intel's attempt to change course has proven difficult, as evidenced by the 60% fall in stock value so far this year, interrupting a once-stable growth trajectory.

In contrast to Intel's financial troubles, Arm Holdings shares have soared since its initial public offering (IPO) last September, rising 65% year to date. The company, which is largely owned by SoftBank Group CorporationIntel benefits from licensing semiconductor designs and blueprints across the industry, including deals with Intel itself. Despite the sale, Intel retains stakes in several other companies, although these investments have not protected the company from substantial losses. In the second quarter alone, Intel reported a cumulative loss of 120 million dollars through its various capital investments.

While the Arm stock divestiture was a strategic financial move, it has become clear during this turbulent period that Intel is struggling to regain its competitive edge in a sector increasingly dominated by advances in artificial intelligence. The semiconductor landscape is changing, and companies are rapidly evolving to meet the demands created by the rise of AI. Analysts say the turnaround plan, as well as Gelsinger’s leadership, will be critical in determining Intel’s future in this climate.

Given recent structural changes and initiatives, Intel’s decision to sell its stake in Arm represents a shift toward prioritizing liquidity and operational efficiency. This latest initiative is part of a series of bold actions the company is taking to improve its financial position and market competitiveness.

The road ahead for Intel remains a challenging one, as the company must navigate both internal restructuring and fierce external competition. Despite the recent surge in after-hours trading following news of the sale, the broader implications of the company's restructuring remain to be seen. As Intel attempts to regain its status as a leading semiconductor manufacturer, attention will undoubtedly focus on whether these significant changes can produce the necessary results in the face of increasing competition.

In conclusion, Intel’s strategic divestment of Arm Holdings highlights a critical phase in the company’s fight to regain its foothold in the semiconductor industry. With advances in artificial intelligence technology, Intel’s ability to adapt and innovate will be key to its future success.

Through Reuters, Trend strength

Leave feedback about this